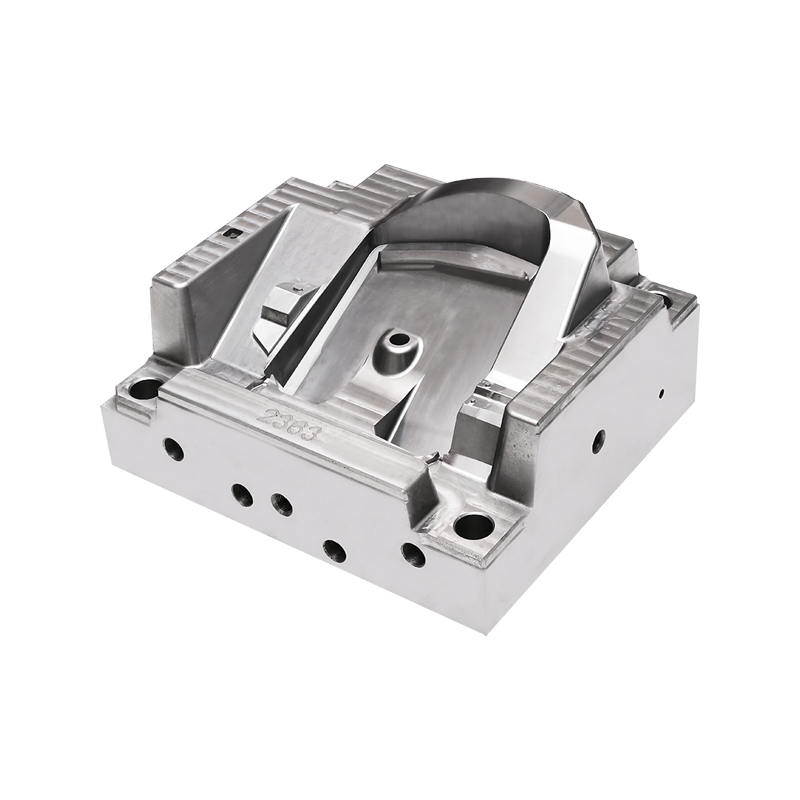

In automotive manufacturing’s high-stakes arena, a strategic evolution is resolving the industry’s persistent dilemma: the choice between precision and affordability. The development of Car Body Moulds – the foundational tools shaping every vehicle skeleton—has catalyzed Southeast Asia’s innovative "semi-finishing" model. This hybrid approach bridges the gap between premium Western/Japanese tooling and budget Asian alternatives, redefining global production economics.

The Precision-Cost Crossroads

For decades, automakers faced a polarized decision: invest in German or Japanese Car Body Moulds costing $800,000-$1.2 million with exceptional million-cycle lifespans, or opt for Chinese alternatives at $250,000-$400,000 with significantly shorter operational lives. This tension intensified with rising EV demand for complex multi-material components requiring microscopic tolerances.

"Japanese Car Body Moulds deliver unparalleled accuracy but inflate production costs beyond sustainability," observes Kenji Tanaka, automotive tooling consultant and former Honda engineering director. "Meanwhile, cheaper solutions often compromise structural integrity after intensive use—particularly problematic for safety-critical components."

Southeast Asia’s Hybrid Solution

The semi-finishing breakthrough leverages complementary strengths across regional borders:

Thailand’s Rough Machining Expertise

Facilities like Bangkok Mould Works perform 85% of material removal on Car Body Moulds. Utilizing cost-efficient labor and localized steel sourcing, they achieve substantial savings while maintaining ±0.15mm accuracy through advanced AI-guided CNC systems. This initial phase reduces processing costs by 40% compared to European operations.

Singapore’s Precision Finalization

Specialized firms, including Precision Mould Solutions, complete the transformation: executing laser polishing to achieve mirror-like Ra 0.05 μm cavity finishes, embedding IoT sensors for real-time performance monitoring, and conducting final tuning to achieve remarkable ±0.03mm dimensional accuracy. This stage ensures the resulting Car Body Moulds meet exacting global standards.

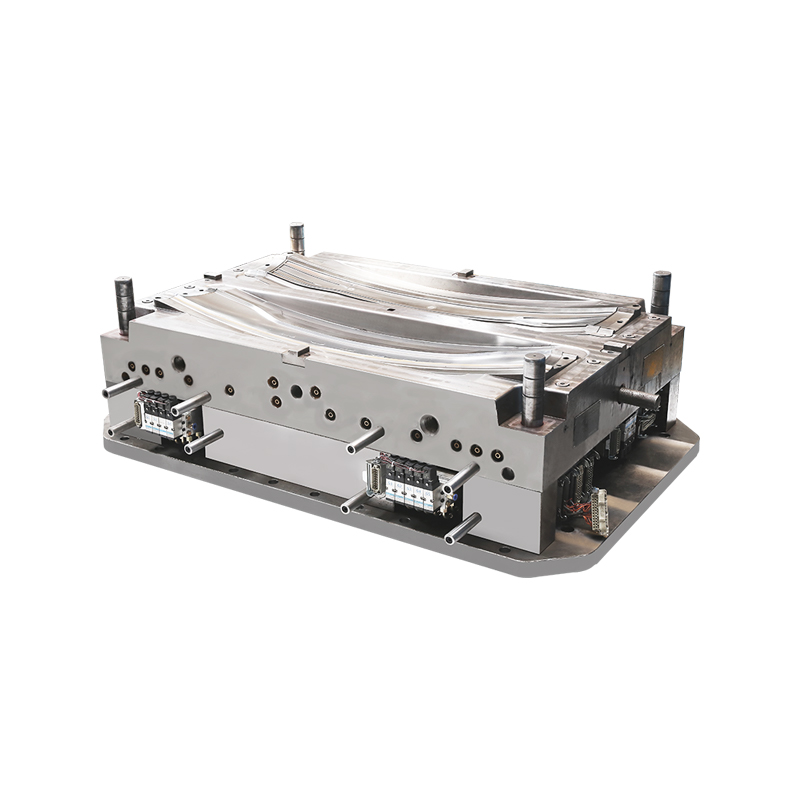

Vietnamese EV innovator VinFast demonstrated this model’s effectiveness when developing Car Body Moulds for their VF9 SUV’s critical roof panels:

Challenge: Required 2-meter molds maintaining exceptional 0.1mm flatness variance—significantly tighter than the industry’s 0.3mm standard—while cutting costs by 35% versus European options.

Execution: Thailand’s Siam ToolTech performed bulk machining on $320,000 mold bases before Singapore’s Nanyang Precision executed final surface mastering.

Outcome: The resulting Car Body Moulds achieved 750,000 operational cycles while maintaining ±0.08mm precision after 100,000 stampings. At $520,000 per mold, VinFast realized 35% cost savings while achieving 98% defect-free panels. Production chief Le Minh confirmed: "These Car Body Moulds delivered premium performance without premium expenditure."

Industry Transformation

The semi-finishing model triggers widespread adaptation:

Japanese investment surges as Mitsubishi Heavy Industries establishes a Car Body Moulds finishing center in Singapore

European manufacturers like Vogel Tooling adopt hybrid workflows, shipping semi-finished Car Body Moulds from Thailand for final hardening in Germany

Portable 3D scanning technology enables seamless cross-border quality verification, slashing rework requirements by 70%

Regional Capability Assessment

This redistribution highlights distinctive competencies: German and Japanese expertise remains unmatched for ultra-precision R&D, though hampered by substantial labor costs. China maintains dominance in mass production velocity but faces material consistency challenges. Southeast Asia’s emerging corridor offers balanced cost-accuracy optimization, though it is still developing experience with mega-scale Car Body Moulds projects.

Toyota’s procurement strategy reflects this new reality: "For non-structural components like fenders or trim panels, Southeast Asian semi-finished Car Body Moulds deliver near-premium quality at decisive cost advantages. The value proposition is transformative."

Forward Momentum

Regional capability development accelerates:

Thailand targets ±0.05mm roughing accuracy by 2026 through thermal compensation R&D

Singapore pioneers AI-powered "distortion prediction algorithms" for large-scale Car Body Moulds

Malaysia emerges as a specialist in corrosion-resistant coatings for battery enclosure tooling

"The evolution of Car Body Moulds manufacturing parallels automotive globalization itself," concludes Frost & Sullivan analyst Priya Sharma. "Collaborative specialization creates value where isolation creates compromise." As automakers navigate the precision-cost continuum, Southeast Asia’s hybrid model delivers the balanced solution the industry demanded.

English

English 中文简体

中文简体 русский

русский Español

Español